Introduction

There’s something irresistibly liberating about a lifestyle unbound by borders. Whether you’re sipping espresso in a Lisbon café or working remotely from a beachside villa in Bali, being a digital nomad means freedom—except when it comes to banking. Traditional banks? They weren’t designed for the globe-trotting lifestyle. But thankfully, Revolut was.

Enter this Revolut Review: Banking for Nomads—a no-hype, all-substance breakdown of what it really feels like to carry your bank in your pocket while you chase sunsets. Let’s explore what makes Revolut a game-changer for the ever-moving tribe of online entrepreneurs, freelancers, and remote workers.

Revolut Review: Banking for Nomads

Revolut isn’t just a fintech company—it’s a movement. With a sleek app and borderless banking philosophy, Revolut has become a financial ally for nomads worldwide. In this Revolut Review: Banking for Nomads, we’ll pull back the curtain on its strengths, challenges, and whether it lives up to its reputation.

From currency exchange that won’t bleed your budget to instant spending analytics and cryptocurrency support, Revolut combines finance and flexibility in a way that resonates with global users. But is it really the “one app to rule them all” for nomads?

Let’s dive deeper.

Why Revolut Appeals to Digital Nomads

Revolut doesn’t just serve customers—it understands them. Digital nomads crave simplicity, mobility, and control. Revolut’s multi-currency accounts, real-time notifications, and location-aware security options check all the boxes.

It allows you to:

- Hold and exchange money in over 30 currencies.

- Withdraw globally at ATMs with transparent rates.

- Send and receive payments instantly.

- Track spending habits in real-time with visual analytics.

This isn’t your grandfather’s bank—it’s your new financial command center.

Setting Up an Account with Revolut

Opening a Revolut account feels more like signing up for Netflix than starting a bank account. The process is straightforward:

- Download the app.

- Submit basic ID verification.

- Choose a plan—Standard (free), Plus, Premium, or Metal.

- Done. You’re now officially global.

There’s no need for proof of residency, no waiting in line, and no paperwork. Just a couple of taps and you’re ready to go. Perfect for nomads who switch time zones more often than socks.

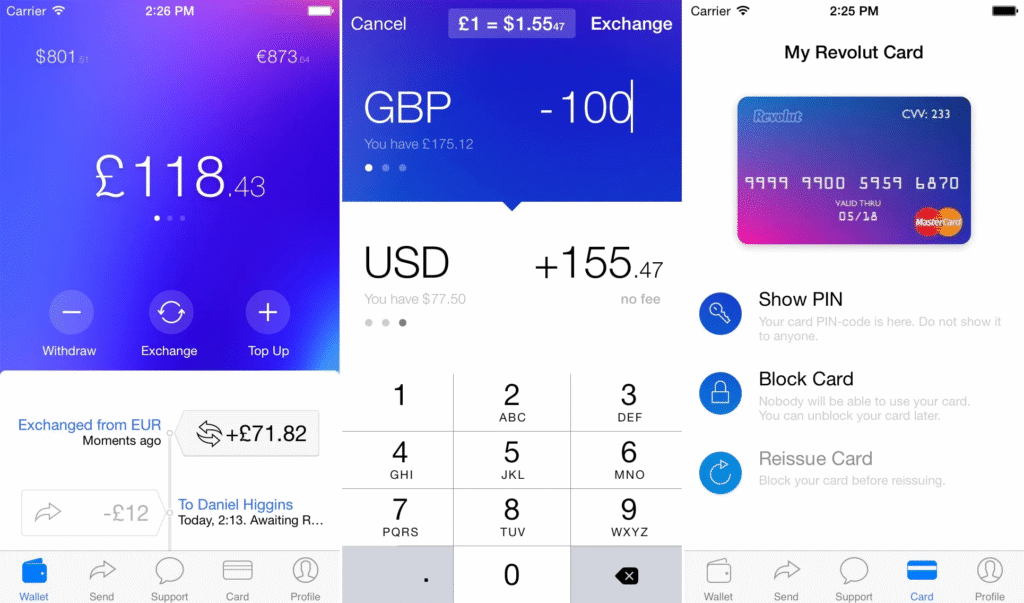

User-Friendly Mobile App

The Revolut mobile app is more than intuitive—it’s downright enjoyable. The user interface feels modern and accessible, even for non-tech-savvy users. The dashboard greets you with everything you need: current balances, latest transactions, exchange rates, and budgeting goals.

Features you’ll love:

- Instant alerts every time money enters or leaves.

- Easy top-ups from your local or other international accounts.

- Freeze/unfreeze your card instantly if lost or stolen.

- Widgets and analytics that show you where your money goes—literally.

Managing Multiple Currencies

Digital nomads often get stuck in currency chaos. Revolut brings order to the madness. You can hold balances in dozens of currencies and switch between them with competitive exchange rates.

- Currency Balances: USD, EUR, GBP, JPY, AUD, and more.

- Auto-convert feature: Set target rates and convert automatically.

- No hidden markups: Transparent mid-market rates (especially on weekdays).

With a single tap, you can pay your rent in Euros, grab sushi in Yen, and fly out using your USD balance.

Low Fees for International Transfers

One of Revolut’s biggest draws is its commitment to low-cost or even free global transfers. Forget Western Union’s high fees or PayPal’s shady exchange rates. Revolut enables:

- Fee-free transfers between Revolut accounts globally.

- Bank transfers in local currencies with reduced transaction costs.

- Scheduled payments to vendors, landlords, and freelancers.

It saves you time and money—two resources every nomad guards like gold.

Global Spending with Revolut Card

The physical Revolut card is a magic key to the global economy. Accepted almost anywhere Mastercard or Visa is taken, it lets you spend like a local, regardless of location.

- Tap-to-pay enabled.

- No foreign transaction fees (based on your plan).

- Vault rounding: Round up purchases to save spare change.

No more awkward glances or rejected cards abroad—just seamless, modern spending.

Currency Exchange at Competitive Rates

Forget airport exchange counters or bank-rigged conversions. Revolut shines in real-time currency exchange with minimal markup.

- Mid-market rates for most transfers and exchanges.

- Real-time conversion calculators in the app.

- Best rates Monday to Friday; weekend surcharges may apply (1%-2%).

Frequent travelers say the difference in rates alone justifies using Revolut.

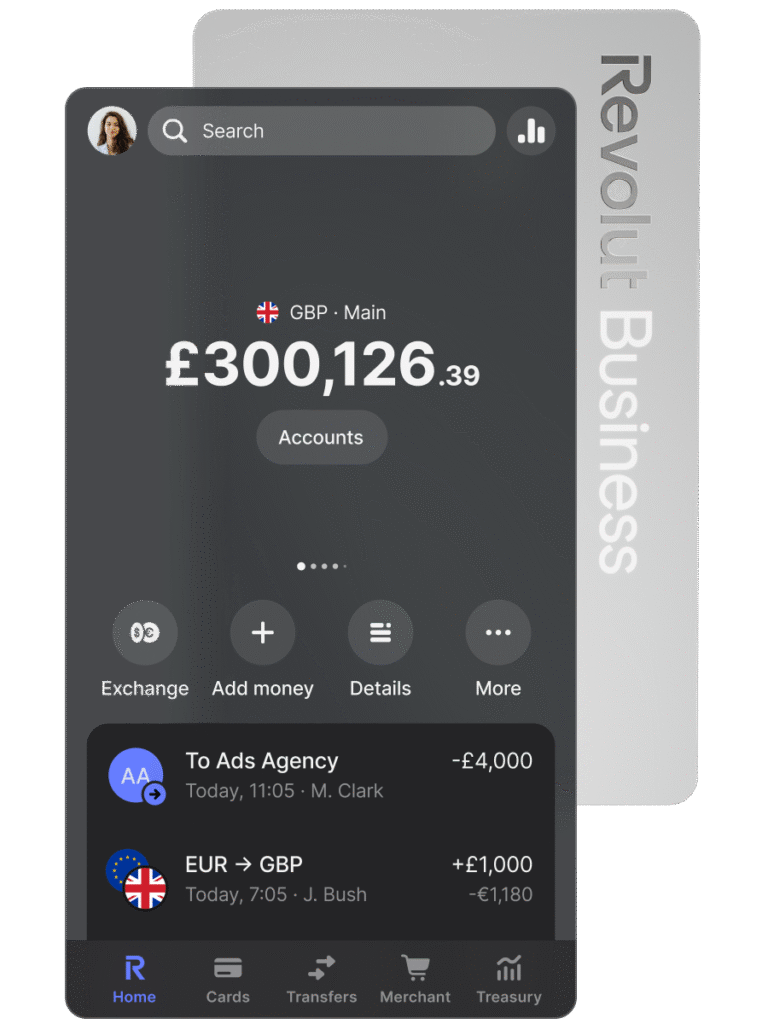

Revolut for Freelancers and Entrepreneurs

Revolut offers more than personal finance. The Revolut Business platform is tailored for:

- Freelancers billing clients in different currencies.

- Remote agencies handling payroll globally.

- Startups managing multi-market operations.

From bulk payments to custom invoices and API integrations, the ecosystem supports scale without borders.

Budgeting and Financial Tools

The app acts as your financial advisor in your pocket. You can:

- Set monthly budgets by category.

- Create spending limits.

- Use real-time analytics to manage habits.

The smart categorization of spending (food, travel, subscriptions) keeps your finances transparent and manageable—even on the move.

Savings and Vaults

Even digital wanderers need savings. Revolut’s Vaults feature lets you stash cash quickly:

- Create custom vaults (Emergency Fund, Travel Fund).

- Save manually or via round-up automation.

- Set goals and track progress.

It’s a minimalist way to save without overthinking it.

Cryptocurrency Integration

For those riding the blockchain wave, Revolut offers in-app access to crypto markets:

- Buy, hold, or sell popular tokens (BTC, ETH, ADA, etc.).

- Real-time charts and alerts.

- Optional auto-convert to crypto from your spare change.

Note: Not available in every country and should be used with awareness of tax and regulation.

Travel Insurance and Perks

Higher-tier plans (Premium, Metal) unlock travel insurance, covering:

- Emergency medical care abroad.

- Trip cancellation and delays.

- Luggage protection.

Other perks include airport lounge access, cashback, and exclusive card designs. For frequent flyers, it’s peace of mind built into your wallet.

Customizable Security Features

Security isn’t optional—it’s essential. Revolut lets you:

- Set spending limits per region.

- Disable online or ATM withdrawals with one tap.

- Enable location-based security (your card only works where your phone is).

No more worrying about card skimming or fraud while you’re island hopping.

Customer Support for Nomads

Let’s be honest: support can make or break a fintech service. Revolut’s in-app 24/7 live chat is responsive and helpful for most queries.

- Multilingual agents.

- Response time: usually under 10 minutes.

- FAQ hub and community forums.

Premium and Metal users often get priority support—another reason to consider the upgrade.

Revolut Business Accounts

Running a digital business? Revolut Business is the Swiss Army knife of online finance:

- Bulk payments.

- Automated payroll.

- Seamless integration with accounting tools (Xero, QuickBooks).

You get a dedicated IBAN, team permissions, and expense management in one place.

Community and Networking

Revolut has built a thriving global community of users—many of them remote workers and entrepreneurs. The platform offers:

- User forums and city-based Revolut events.

- Exclusive perks and merchant offers.

- A referral program with cash bonuses.

Banking becomes more than a tool—it becomes a movement.

Pros and Cons of Using Revolut Abroad

Pros:

- Excellent exchange rates.

- Fast, low-cost transfers.

- Multi-currency management.

- Extensive travel perks.

Cons:

- Limited cash deposits.

- Some features depend on your plan.

- Weekend currency markup applies.

Still, the pros far outweigh the cons for most users.

Comparing Revolut to Other Digital Banks

Unlike Wise, which focuses mainly on transfers, or N26, which is EU-centric, Revolut offers a broader suite of services—from crypto to budgeting and even stock trading.

- Wise: Cheaper transfers, fewer extras.

- N26: Sleek design, EU-only.

- Revolut: All-in-one for nomads and freelancers.

How Reliable is Revolut for Nomads?

Revolut is backed by full banking licenses in the EU and UK, meaning funds are protected under the Financial Services Compensation Scheme. It’s also expanding its global footprint, including the US, Singapore, and Australia.

Connection issues? Rare. App bugs? Occasionally—but updates roll out quickly.

Regulatory Compliance and Licensing

Security is more than flashy features—it’s about regulation. Revolut holds:

- Full banking license in the EU.

- E-money license in the UK.

- Strict anti-money laundering (AML) practices.

- 2FA and biometric login.

It’s not a cowboy app—it’s a regulated financial institution.

FAQs

Is Revolut safe to use while traveling?

Yes, Revolut is licensed and uses advanced encryption, two-factor authentication, and location-based security.

Can I use Revolut in every country?

Revolut works in 150+ countries, but some features (like crypto or insurance) vary by region.

Does Revolut charge foreign transaction fees?

No, there are no foreign transaction fees within your monthly limit. Weekend exchange fees may apply.

Which Revolut plan is best for digital nomads?

The Premium or Metal plans offer the most perks—especially travel insurance, lounge access, and higher limits.

How do I load money into my Revolut account?

Use linked bank accounts, cards, or even Apple/Google Pay. Top-ups are instant.

Is Revolut better than PayPal for nomads?

For spending and conversions, yes. PayPal excels in business invoicing, but Revolut is more versatile for everyday use.

Conclusion

In this Revolut Review: Banking for Nomads, one thing is clear—Revolut isn’t just a handy app, it’s a toolkit for modern, mobile living. From the coffee shop in Colombia to the coworking space in Croatia, it empowers you to manage money with clarity, control, and confidence.

For nomads, freelancers, and digital hustlers, Revolut may just be the smartest travel companion you ever bring.