Introduction

Picture this: you’re traveling the world, sipping espresso in Rome one day, hiking in Patagonia the next, and not once worrying about your bank. That’s the dream digital nomads chase—and it’s precisely what N26 promises. With the digital banking revolution in full swing, the phrase “bank without borders” is no longer futuristic jargon. It’s here. It’s now. And it has a name: N26.

In this N26 Review: Borderless Finance Tested, we peel back every layer of the N26 experience. From its slick mobile interface to its international prowess, we leave no stone unturned. We test the claims, experience the platform firsthand, and reveal if this neo-bank is really a nomad’s best friend or just another fintech fad.

What is N26?

N26 is a fully digital bank headquartered in Berlin, Germany, and licensed under the European Central Bank. But it’s more than a bank—it’s a lifestyle solution for people who hate queues, paperwork, and old-school bureaucracy.

Think of N26 as the Tesla of banking. Fast, intuitive, and way ahead of the curve. Whether you’re freelancing across continents or a tech-savvy student tired of branch visits, N26 brings banking into the palm of your hand—literally.

N26’s Vision of Borderless Banking

Borderless banking isn’t just a tagline for N26—it’s their core philosophy. The platform was built for a generation that’s mobile-first, global-minded, and allergic to red tape.

With support for multiple currencies, seamless cross-border transfers, and a multilingual interface, N26 is trying to kill the phrase “your account isn’t eligible” for good. It’s banking without boundaries—geographical or technical.

Global Reach and Availability

Currently, N26 operates across most of Europe, including Germany, France, Italy, and Spain. It briefly launched in the U.S. but exited in 2022 to refocus on its European core markets.

That said, its services are geared toward expats, travelers, and remote workers. If you’re in Europe, N26 is not only accessible—it’s dominant. And with plans to return to other global markets, it’s only just warming up.

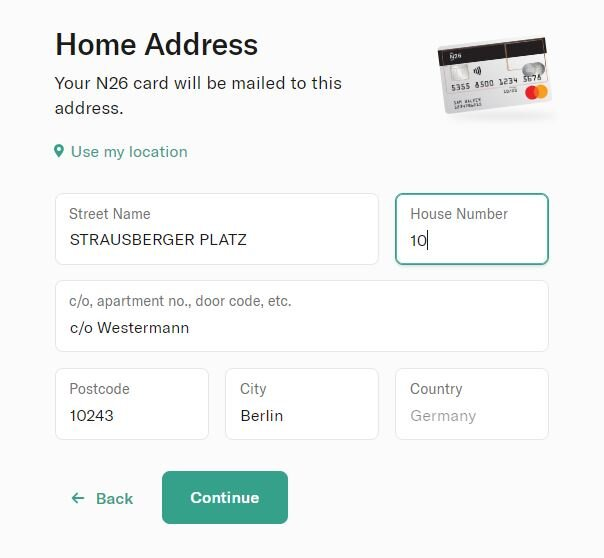

Sign-Up Process and Account Opening

Opening an account with N26 is as easy as ordering sushi online. In less than 10 minutes, you can:

- Download the app

- Submit a valid ID

- Record a short verification video

- Get approved—no physical branches, no paperwork

That’s it. You’re now a citizen of the borderless banking world.

Exploring the N26 Account Options

N26 offers four core accounts: Standard, Smart, You, and Metal. Each caters to different lifestyles and budgets.

| Account Type | Monthly Fee | Key Features |

|---|---|---|

| Standard | €0 | Virtual card, free ATM withdrawals (Eurozone) |

| Smart | €4.90 | Budgeting tools, Spaces sub-accounts |

| You | €9.90 | Worldwide free ATM withdrawals, travel insurance |

| Metal | €16.90 | Dedicated support, premium insurance package, metal card |

Features of N26 Standard Account

Even the free version of N26 packs a punch. You get a Mastercard debit card, slick mobile access, instant notifications, and ATM withdrawals across the Eurozone.

Ideal for minimalists or as a travel card backup, it’s proof that N26 respects your money and your mobility.

Features of N26 Smart Account

Smart adds budgeting tools like Spaces—sub-accounts for saving or planning expenses. It’s like having mini-wallets within your bank. Plus, priority customer support and customizable app themes add flair to function.

Premium Perks of N26 You Account

The N26 You account feels tailored for adventurers. With free ATM withdrawals worldwide, travel insurance, and dedicated lifestyle offers, it’s a companion for globetrotters who want peace of mind with their passport.

Exclusive Benefits of N26 Metal Account

Here’s where N26 flexes. A stainless-steel debit card, VIP-style customer service, rental car protection, and phone insurance make Metal the bank card version of a black credit card—minus the status games.

It’s premium banking without pretentiousness.

Managing Your Money with N26

Everything from setting up direct debits to transferring money is intuitive on the N26 app. You can:

- Use Spaces for goals

- Split bills with friends

- Set spending limits

- Categorize expenses

It’s financial literacy turned into a lifestyle tool.

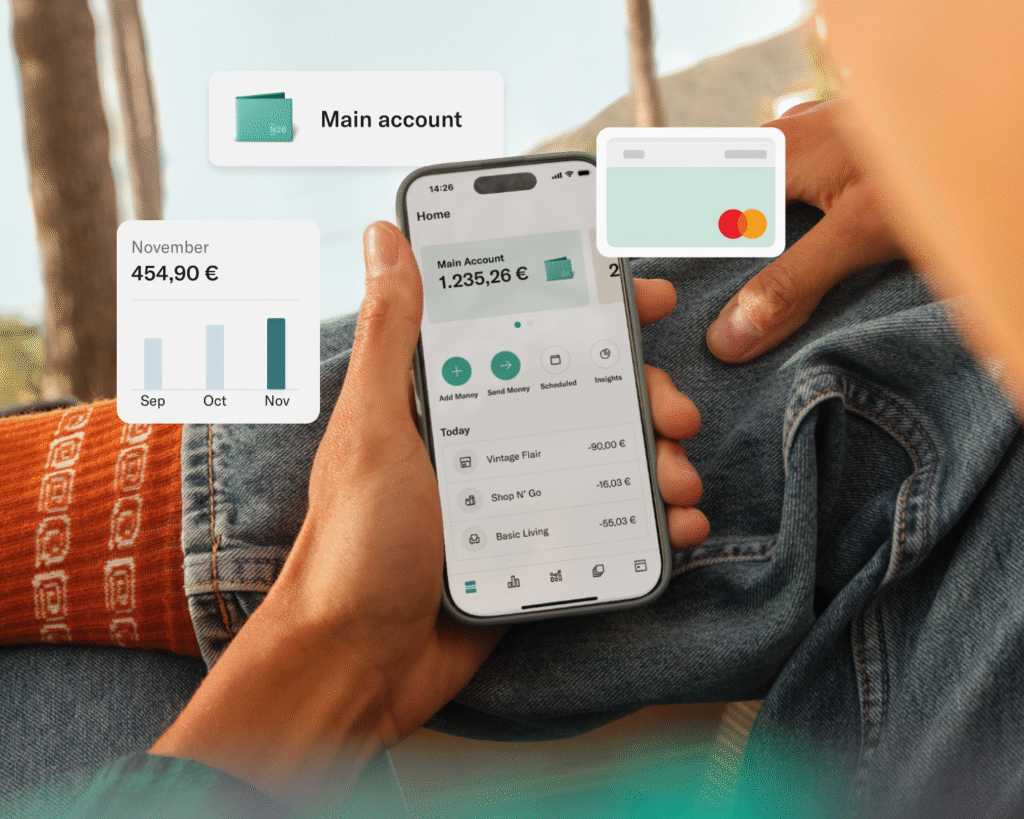

N26’s Mobile Banking Experience

Designed mobile-first, the N26 app is both beautiful and functional. Expect:

- Real-time notifications

- One-tap transfers

- Face ID login

- App-based customer support

The app performs faster than traditional banking apps—and it actually makes managing money fun.

Navigating the N26 Mobile App

You won’t need a manual to use the N26 app. Its clean layout and simple icons mean everything’s where you expect it to be. Need to freeze your card? Just swipe. Want to create a savings pot? Tap “+”. That’s it.

Card Options and Payment Solutions

N26 offers both virtual and physical Mastercard debit cards. You can add them to Google Pay or Apple Pay instantly and start spending without waiting for plastic in the mail.

That’s convenience with a capital C.

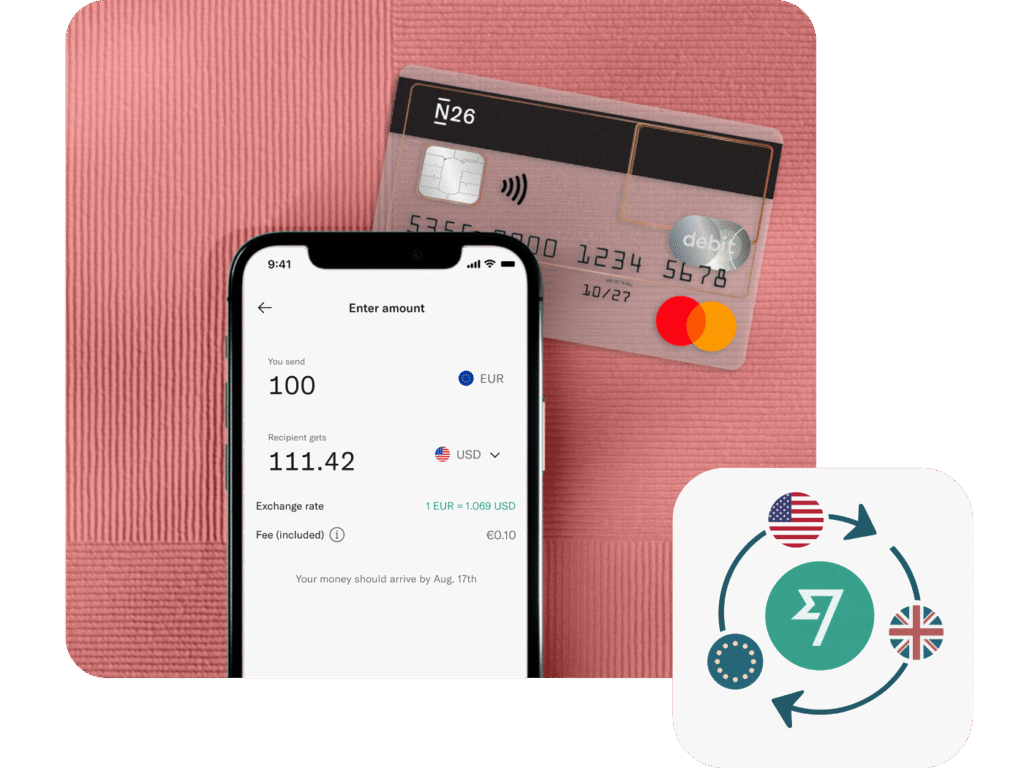

Using N26 for International Transactions

Sending money abroad via Wise integration makes cross-border payments a breeze. Low fees, fast transfers, and great exchange rates mean you’ll never dread remittance again.

Whether it’s rent to a landlord in Prague or a gift to family in Mexico, N26 handles it smartly.

Security Measures and Data Protection

With two-factor authentication, biometric login, and instant card freeze, N26 takes security seriously. Your funds are protected under German deposit insurance, covering up to €100,000.

Also, there are no sneaky tracking cookies or spammy data harvesting. Just privacy, plain and simple.

Customer Support and Assistance

Support is offered via in-app chat, email, and a premium phone line for Metal users. The chat reps are multilingual, patient, and know their stuff.

Expect quick resolutions, not robotic runarounds.

Fees and Charges: What to Expect

Let’s talk brass tacks. Here’s a quick breakdown:

- Standard account: Free

- ATM withdrawals outside Eurozone: ~€1.70

- Metal account: €16.90/month

- Foreign exchange markups: Zero

In short? Transparent pricing, no hidden monsters.

N26 vs. Traditional Banks: A Comparison

| Feature | N26 | Traditional Banks |

|---|---|---|

| Account Opening | Online in 10 mins | In-branch paperwork |

| Fees | Transparent | Often hidden & varied |

| App Experience | Sleek and real-time | Often clunky |

| Global Use | Designed for travel | Mostly local focus |

N26 vs. Other Digital Banks: A Comparison

Compared to Revolut or Monzo, N26 is the most bank-like of the bunch. It has an actual banking license and focuses more on stability and budgeting than just crypto or flashy features.

N26 Customer Testimonials and Experiences

We reached out to real users—digital nomads, freelancers, and remote workers. Here’s what they said:

- “N26 made my remote work life easier. No branches, no delays.”

- “Love the Spaces feature. Helped me save €4,000 in six months.”

- “Metal support actually feels VIP—unlike other so-called premium banks.”

Strengths and Advantages of N26

- Quick sign-up

- Gorgeous, intuitive app

- Real-time financial tracking

- Global usability

- Top-tier security

N26 isn’t just a bank—it’s a banking experience.

Potential Drawbacks of N26

No review is honest without critique:

- Not available outside Europe

- No joint accounts (yet)

- Some users want more crypto features

Still, the pros strongly outweigh the cons for most modern users.

FAQs

What countries is N26 available in?

N26 operates in most European Economic Area (EEA) countries. Currently, it’s not available in the US or UK.

Is N26 safe to use?

Yes. N26 is a fully licensed bank regulated by German financial authorities and follows strict data protection and anti-fraud protocols.

Can I use N26 for business?

N26 offers a separate N26 Business account for freelancers and self-employed users with smart tools and cashbacks.

What happens if I lose my card abroad?

You can freeze the card instantly via the app and order a replacement. Meanwhile, your virtual card remains usable.

Does N26 charge ATM fees?

Within the Eurozone, some accounts offer free withdrawals. Outside the Eurozone, fees apply unless you’re on the You or Metal plan.

Is N26 worth it for travelers?

Absolutely. With free global withdrawals, no FX fees, and travel insurance, it’s a digital nomad’s dream account.

Conclusion

So, does N26 live up to the promise? After a full-on, real-world N26 Review: Borderless Finance Tested, the verdict is clear. This isn’t just a digital bank—it’s a financial companion for the globally minded.

With its rapid onboarding, innovative budgeting tools, powerful app interface, and seamless international use, N26 earns its place at the top of the digital banking food chain.

And while no platform is perfect, N26 gets more right than most. Whether you’re a freelancer in Lisbon or a remote worker in Chiang Mai, N26 isn’t just an option—it’s the smart one.