Introduction: The Allure of Income That Never Sleeps

Picture this: You wake up, check your phone, and see that you made money while you were sleeping. That isn’t a fantasy anymore. It’s the new financial reality shaped by digital opportunity and intelligent planning.

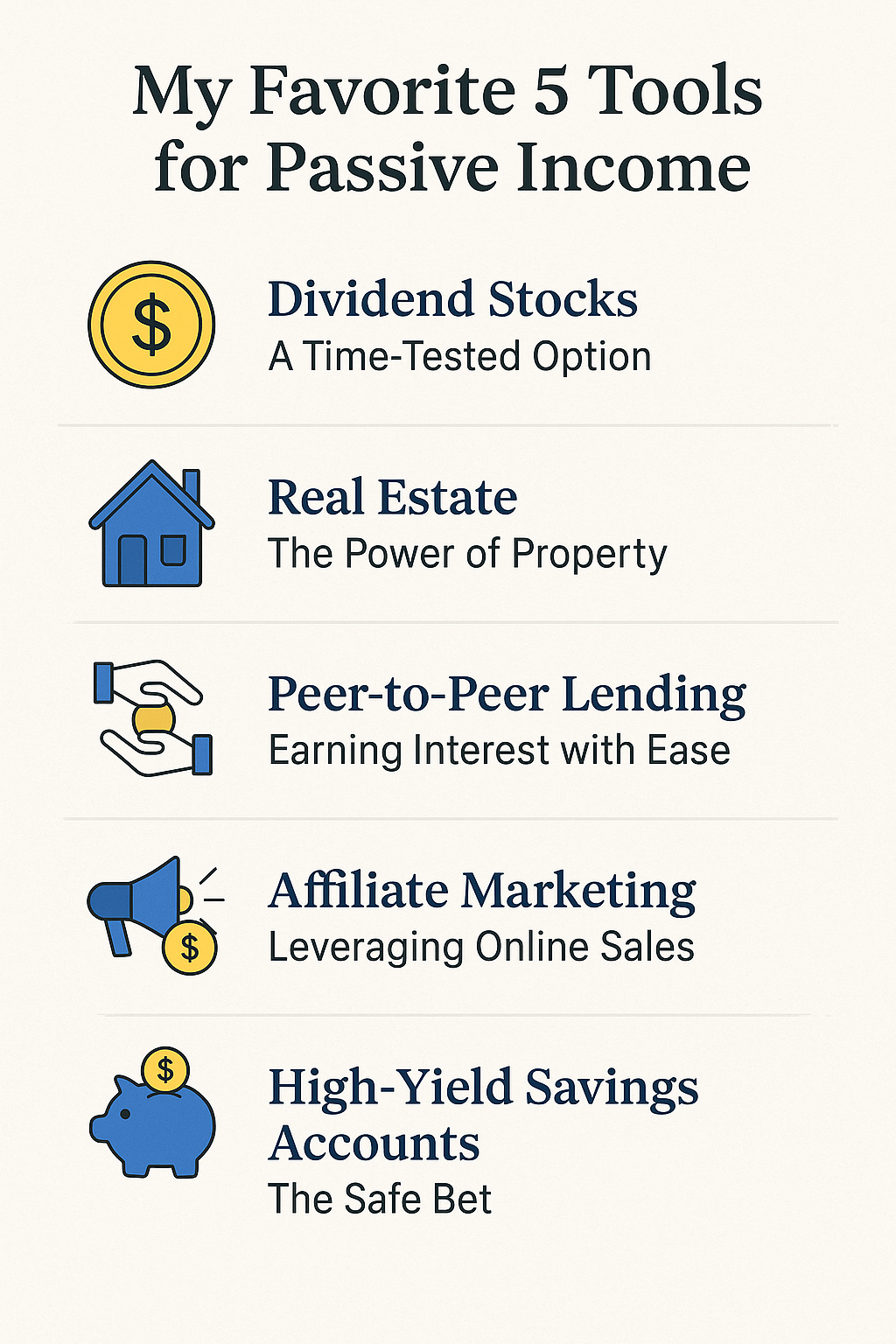

My Favorite 5 Tools for Passive Income didn’t just change my finances—they reshaped how I think about money, freedom, and work. What once felt like a grind now feels like a game of systems. I’ll walk you through each of these tools, not from theory, but from hands-on results and real-life progress.

But before diving in, let’s set the stage properly.

Understanding Passive Income

Passive income is money that flows in without you having to trade your time constantly for it. Unlike a 9-to-5 job, where effort equals income, passive income flips the formula. It says: build once, earn often.

Whether it’s through investments, online platforms, or digital assets, the central idea is the same: build leverage. You create something (or invest in it) once, and it keeps giving back. But don’t let the word “passive” fool you. These tools require strategy, discipline, and a sharp eye—especially at the beginning.

The Importance of Diversification

One lesson I’ve learned early is this: don’t put all your eggs in one income basket. Each of My Favorite 5 Tools for Passive Income plays a different role—some are steady and safe, others are riskier but high-reward. The real magic happens when they work together like a well-oiled machine.

Diversifying gives you protection against economic shifts, market downturns, and platform changes. It’s like having multiple backup generators when the main power line fails.

My Favorite 5 Tools for Passive Income

This is the moment you’ve been waiting for. These are the exact tools that took my earnings from $0 to a sustainable passive stream:

- Dividend Stocks — A Time-Tested Option

- Real Estate — The Power of Property

- Peer-to-Peer Lending — Earning Interest with Ease

- Affiliate Marketing — Leveraging Online Sales

- High-Yield Savings Accounts — The Safe Bet

Let’s unpack each one in depth.

Dividend Stocks — A Time-Tested Option

Stocks that pay dividends are like owning a slice of a business that rewards you consistently. They distribute a portion of their profits to shareholders—just for holding the stock.

Benefits of Dividend Investing

- Recurring income every quarter

- Potential capital appreciation

- Reinvested dividends can snowball into wealth

Selecting the Right Dividend Stocks

Look for companies with a history of increasing dividends annually. Think blue-chip stocks like Johnson & Johnson, Coca-Cola, or Procter & Gamble.

| Metric | Ideal Range |

|---|---|

| Dividend Yield | 2% – 5% |

| Dividend Growth | Positive over 5–10 years |

| Payout Ratio | Below 70% |

Managing Your Dividend Portfolio

Don’t just set it and forget it. Track performance quarterly, diversify across sectors, and consider dividend reinvestment plans (DRIPs) to amplify growth.

Real Estate — The Power of Property

Real estate might not seem “passive” at first glance, but the right systems and rental structures can make it a steady, semi-automated income source.

Benefits of Real Estate Investments

- Tangible asset that appreciates

- Rental income monthly

- Tax advantages through depreciation

Choosing Profitable Properties

Look for properties in growing markets with low vacancy rates. Use cash flow calculators before making a move.

Managing Investment Properties

Use property managers or platforms like Roofstock and Doorstead for hands-off maintenance. Set automatic rent collection through tools like Cozy or Avail.

Peer-to-Peer Lending — Earning Interest with Ease

This underrated tool surprised me with its simplicity and returns. You lend money directly to individuals or small businesses and earn interest over time.

Benefits of Peer-to-Peer Lending

- Better rates than banks

- Controlled risk through portfolio diversification

- Low initial capital needed

Choosing the Right Lending Platforms

Top platforms like LendingClub, Prosper, and Fundrise (for real-estate-backed loans) let you pick loan grades, terms, and borrowers.

Managing Loan Investments

Stick to small loan portions across many borrowers. Use auto-investing to stay consistent and reduce emotional bias.

Affiliate Marketing — Leveraging Online Sales

This is the most exciting part of My Favorite 5 Tools for Passive Income because it blends creativity with strategy. You promote someone else’s product and earn a commission for every sale.

Advantages of Affiliate Marketing

- No inventory or customer service

- Scalable with content and SEO

- Global market access

Finding and Promoting Profitable Products

Use affiliate networks like Amazon Associates, ShareASale, or Impact. Choose evergreen niches like finance, software, or health.

| Platform | Commission Range | Niche Examples |

|---|---|---|

| Amazon | 1% – 10% | Physical Products |

| ClickBank | 30% – 70% | Digital Products |

| Impact | Varies | SaaS, Finance |

Monitoring and Optimizing Campaigns

Track links via PrettyLinks or ThirstyAffiliates. A/B test your landing pages, use email sequences, and study conversion data regularly.

High-Yield Savings Accounts — The Safe Bet

If the other tools are adventurous travelers, this one is your home base. It won’t make you rich overnight, but it keeps your money working, not sleeping.

Why It’s Part of My Favorite 5 Tools for Passive Income

- No risk of capital loss

- Instant liquidity

- FDIC insured

Look for accounts with at least 4.0% APY. Ally, Marcus by Goldman Sachs, and Discover consistently offer strong rates. It’s a reliable tool to park emergency funds or affiliate earnings before investing elsewhere.

Comparing the Tools

| Tool | Risk Level | Time Involved | Returns Potential |

|---|---|---|---|

| Dividend Stocks | Medium | Low | Moderate |

| Real Estate | Medium | Medium | High |

| Peer-to-Peer Lending | Medium | Low | Moderate |

| Affiliate Marketing | High | High (initial) | Very High |

| High-Yield Savings | Low | None | Low |

Risk vs. Reward

Every tool comes with its own balance of effort, volatility, and reward. The key is knowing your personal risk appetite. If you need stable cash flow, dividend stocks or real estate might suit you. For digital hustlers, affiliate marketing opens explosive doors—but it needs patience and consistency.

Time Commitment

Some tools are front-loaded (like affiliate marketing), where you invest time now for later gain. Others, like high-yield savings accounts, are immediate but limited. The blend matters more than the individual piece.

Initial Investment

Start small. I began with under $100 for dividend investing, zero for affiliate marketing, and just a few thousand for my first real estate deal through a REIT. You don’t need to be rich—you just need to be resourceful.

Combining Tools for Maximum Impact

Here’s a secret: the compound power isn’t in using one tool—it’s in combining them. I reinvest affiliate income into dividend stocks. The dividends cover some of my real estate costs. That cash gets reinvested into more content and campaigns.

Creating a Diversified Portfolio

Diversify across platforms and industries. Even within affiliate marketing, I split between blog, email, and social channels. In stocks, I go across healthcare, tech, and finance. Safety isn’t sexy—but it pays off long term.

Balancing Risk and Reward

Use a “core and explore” model:

- Core: safe tools (savings, dividend stocks)

- Explore: high-reward tools (affiliate marketing, P2P lending)

It lets you enjoy upside while sleeping well at night.

Adjusting Strategies Over Time

Your income goals will evolve. So should your strategies. Rebalance quarterly. Review metrics. Retire tools that underperform.

Common Strategies for Success

- Automate where possible

- Repurpose successful strategies

- Track ROI like a hawk

- Celebrate small wins

The Importance of Research

None of this works without informed decisions. Follow expert blogs. Read books like The Millionaire Fastlane and The Psychology of Money. And yes—consult financial advisors when stakes are high.

Setting Realistic Goals

Start with one tool. Don’t try everything at once. Set SMART goals: Specific, Measurable, Achievable, Relevant, Time-bound. Mine was: $100/mo in passive income by Month 3. Hit it in Month 2.

Continuous Learning and Improvement

Every tool is a living machine. Platforms change. Rates fluctuate. SEO rules shift. Stay adaptive, not reactive. That’s how passive becomes permanent.

Potential Challenges and How to Overcome Them

- Analysis paralysis → Start small

- Time scarcity → Use automation

- Tech overwhelm → Learn by doing

- Burnout → Pace yourself

Managing Risks

Mitigate risk through diversification, education, and experience. Losses will come—learn from them.

Maintaining Patience

It’s not a sprint. Passive income compounds like interest—slow at first, then wildly fast. Give it time. Show up. Let the system build.

FAQs

What is the best passive income tool for beginners?

High-yield savings and dividend stocks are great low-risk starting points.

Can I build passive income with no money?

Yes. Affiliate marketing requires zero upfront capital, just time and consistency.

How long does it take to see results?

Results vary. Expect 3–6 months for affiliate marketing. Dividends and interest may start within weeks.

Is passive income really passive?

Not entirely. It requires setup, tracking, and sometimes maintenance. But the reward-to-effort ratio is powerful.

Do I need to be tech-savvy?

Not at all. Most platforms are user-friendly. Plus, there’s a tutorial for everything.

How do I protect my passive income sources?

Diversify. Automate. Stay educated. And always have a backup plan.

Conclusion: Start Building Yours Today

You don’t need luck. You need leverage. My Favorite 5 Tools for Passive Income helped me escape the hamster wheel of work-to-live. They didn’t just pay me—they empowered me.

The question isn’t can you do it—it’s will you start today?